Gross profit calculation formula

Gross Profit Revenue - Cost of Goods Sold. Operating Income Gross Profit - Operating Expenses.

Cape Ratio Accounting And Finance Accounting Principles Financial Management

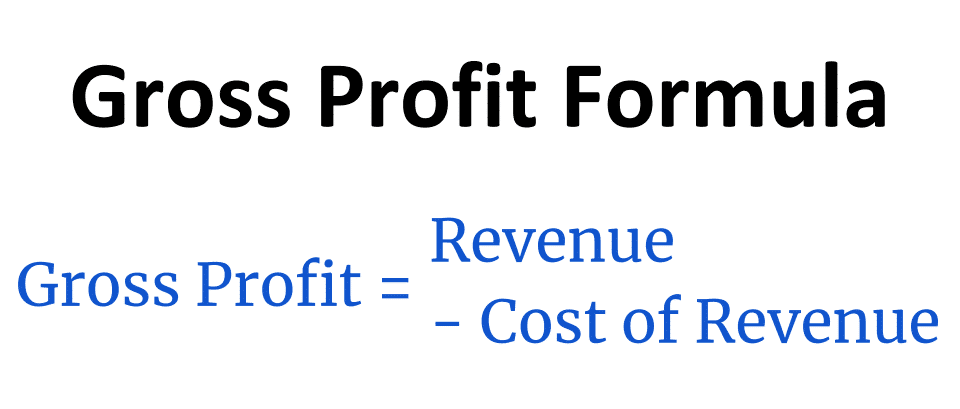

The gross profit formula is.

. The Best Way To Track Expenses Is Using an Easy Powerful Automated App. How to Calculate Gross Profit. Text Gross Profit Revenue Cost of Goods Sold In the equation revenue is the total amount of money collected.

August 10 2022. Gross Profit Revenue Cost of Goods. Net Profit Operating Income - Other Costs.

So if you paid 10000 for goods and sold them for 12000 your gross profit would come to. The formula for gross profit margin involves revenue and the Cost of SalesCost of Goods Sold. How to calculate gross profit.

The gross profit does not include fixed costs such as rent insurance salaries etc. Gross Profit Revenue Cost of Goods Sold COGS As a standalone metric the gross income is not very meaningful which is the reason that it must be. Gross Profit 790 530.

Gross Profit Formula. The gross profit formula is. Then divide this figure by net sales to calculate the.

To calculate manually subtract the cost of goods sold COGS from the net sales gross revenues minus returns allowances and discounts. Ad Mark Your Business Expenses As Billable Pull Them Onto an Invoice For Your Client. Fixed costs dont change based on production.

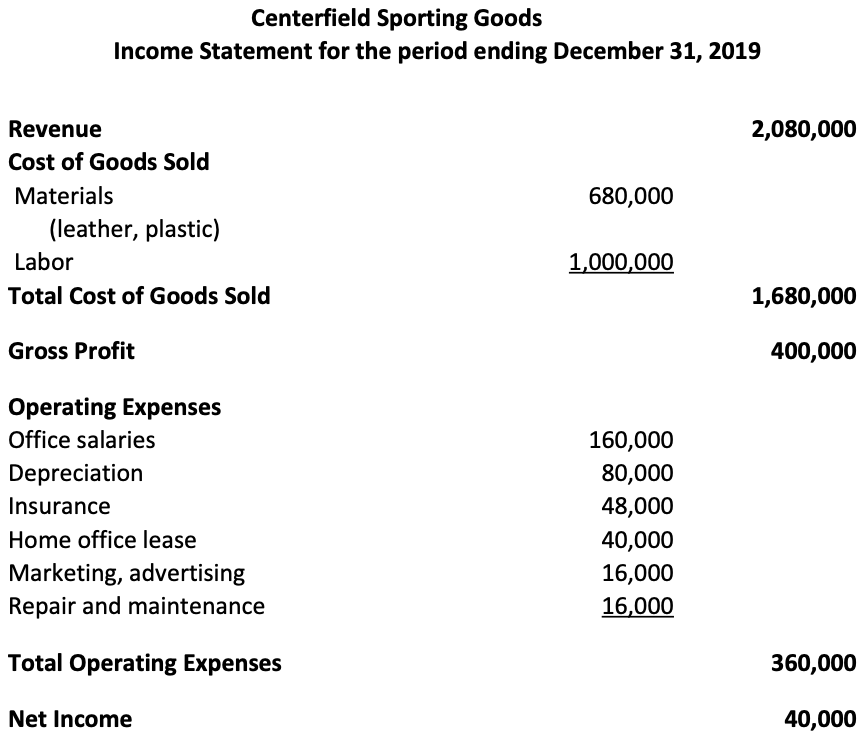

What Is the Gross Profit Formula. Gross Profit Total Sales Revenue Cost of Goods Sold. The gross profit formula is.

The formula looks like this. Revenue is the total money your. You can calculate your gross profit with the following formula.

On the other hand variable expenses are costs that can. Gross Profit Margin Net Sales Cost of Goods Sold Net Sales x 100. Gross Profit Total Sales Revenue Cost of Goods Sold.

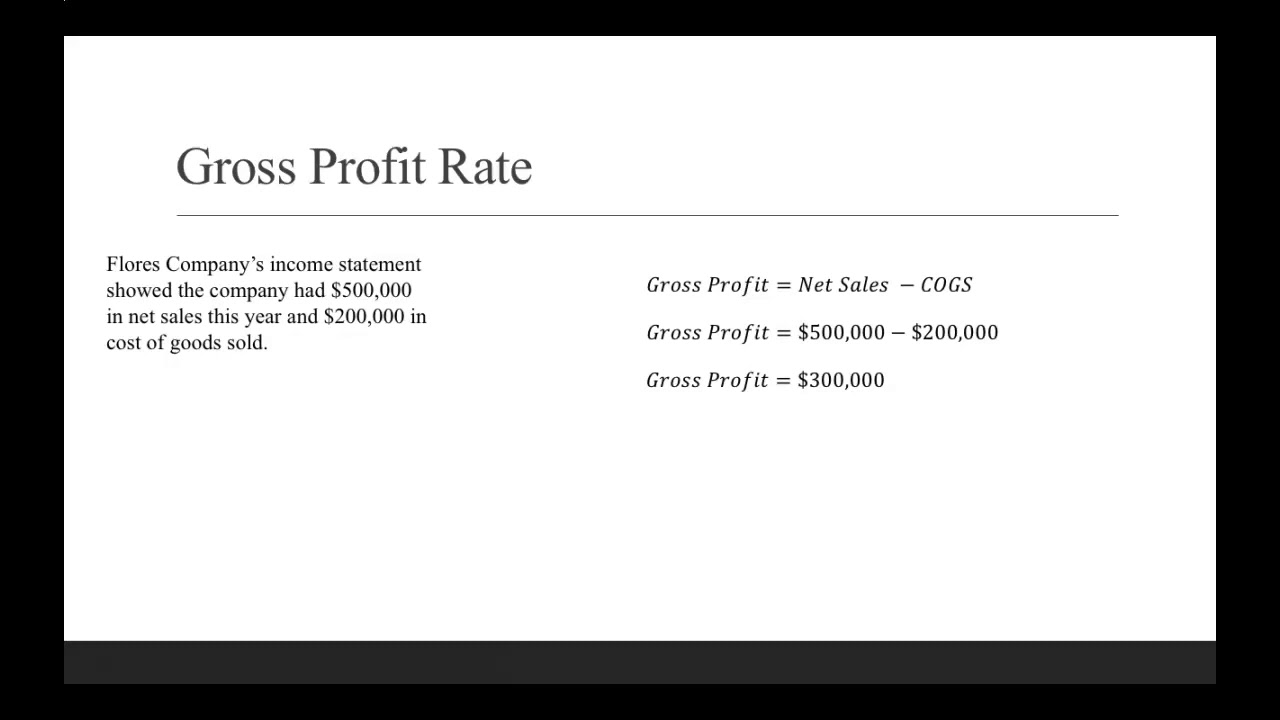

The gross profit formula is the difference between the total sales revenue and the COGS. How to Calculate Gross Profit. Gross profit percent gross profit net sales revenue x 100.

Gross Profit Net Sales Cost of Goods Sold 400000 280000 120000. Using the gross profit margin formula we get. Gross Profit Margin Net Sales COGS Net Sales beginaligned textGross Profit MarginfractextNet Sales -text COGStextNet Sales endaligned Gross.

What is the gross profit formula. Gross Profit also known as sales profit or gross income is the profit a company has left over after paying all direct expenses related to the manufacturing and. But the gross profit formula includes the cost of material used credit card fees of customers equipment.

Gross Margin Gross Profit Revenue 100. The gross profit formula is the difference between the total sales revenue and the COGS. Gross Profit Revenue - Cost of Revenue.

The gross profit ratio is an important financial measurement that evaluates profitability.

Gross Profit Margin Vs Net Profit Margin Formula

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

What Is Gross Profit Definition Formula And Calculation Stock Analysis

/GrossProfit-5c7ce1fdc9e77c00012f8248.jpg)

Gross Profit Vs Net Income What S The Difference

Calculating The Gross Profit Rate Youtube

What Is Gross Margin And How To Calculate It Article

/dotdash_Final_How_Do_Gross_Profit_and_Gross_Margin_Differ_Sep_2020-01-441a7bebdebb492a8ac3a1e3ea890ab9.jpg)

How Do Gross Profit And Gross Margin Differ

:max_bytes(150000):strip_icc()/dotdash_Final_Gross_Margin_vs_Net_Margin_Whats_the_Difference_Nov_2020-01-de889f0261d2482780bda560dc14a6ce.jpg)

How Does Gross Margin And Net Margin Differ

Gross Margin Financial Management Gross Margin Business Tools

Total Comprehensive Income Astra Agro Lestari Tbk 2017 2018 Financial Statements Accounting Income Financial Statement Basic Concepts

Income Statement Template Excel Free Download Statement Template Income Statement Money Saving Tips

The Gross Profit Formula Lower Costs Raise Revenue Quickbooks Australia

Gross Profit Formula Calculator And Example Excel Template

Gross Profit Margin Formula And Calculator Excel Template

![]()

How To Calculate Gross Operating Net Profit Margin

How To Find Gross Profit Definition And Calculation

Gross Profit Is Not The Same As Gross Margin Examples Calculations